Amazing Tips About How To Keep Good Credit Score

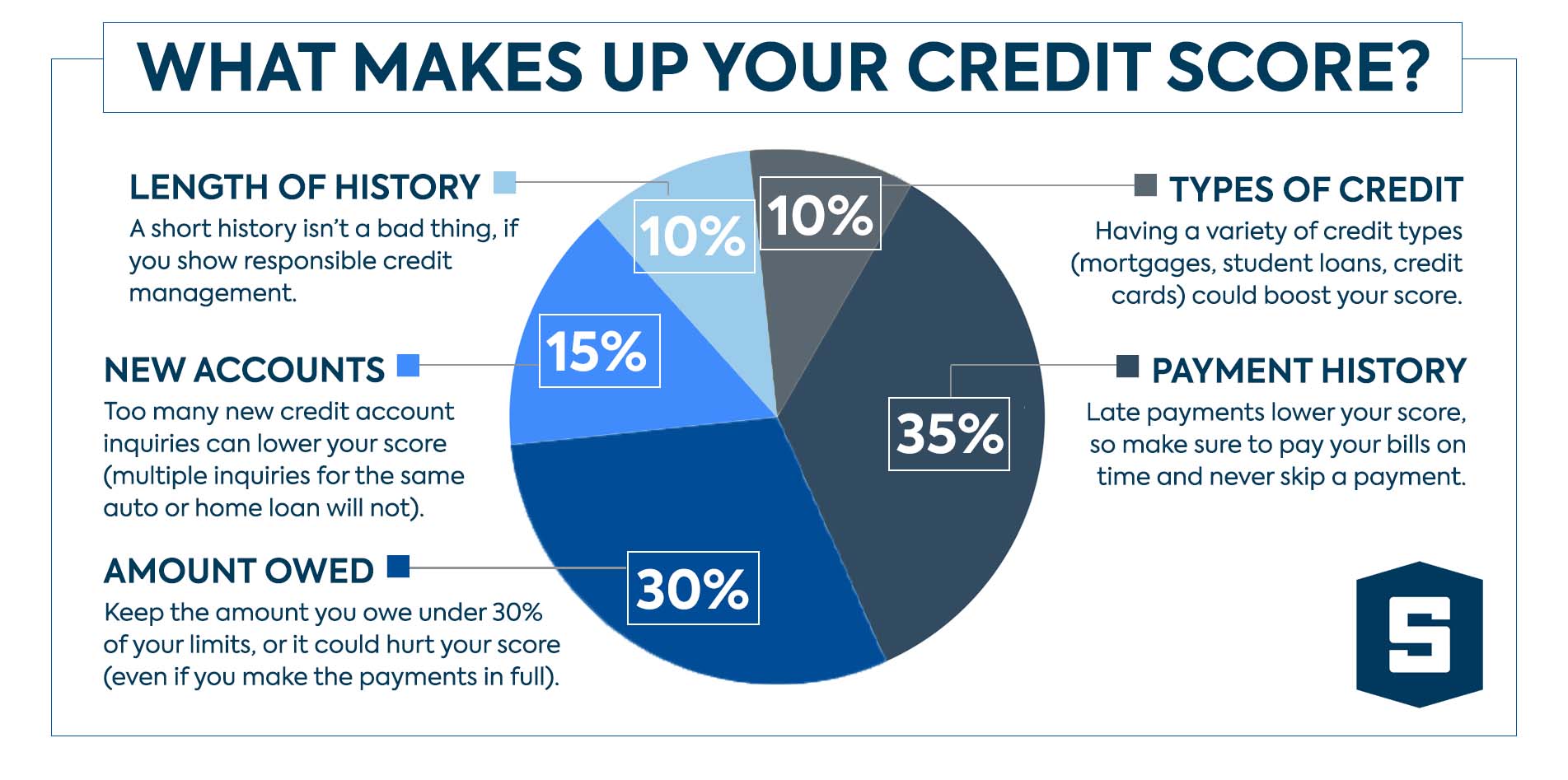

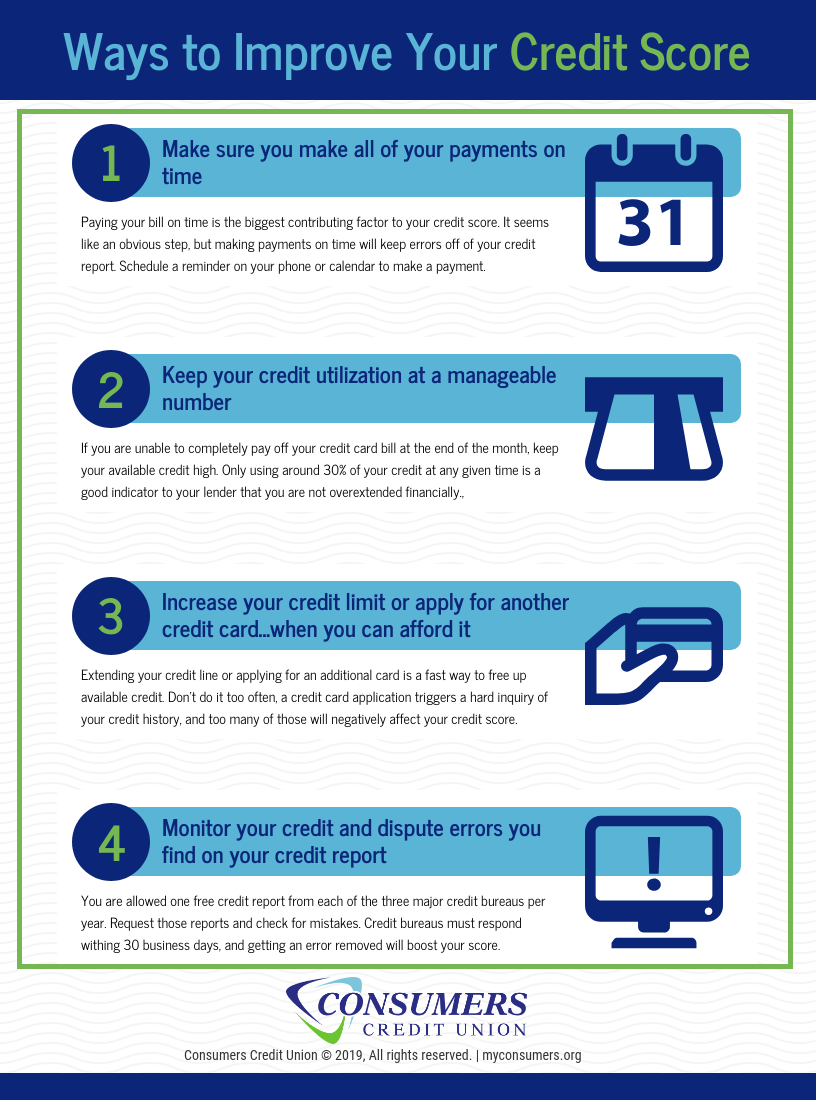

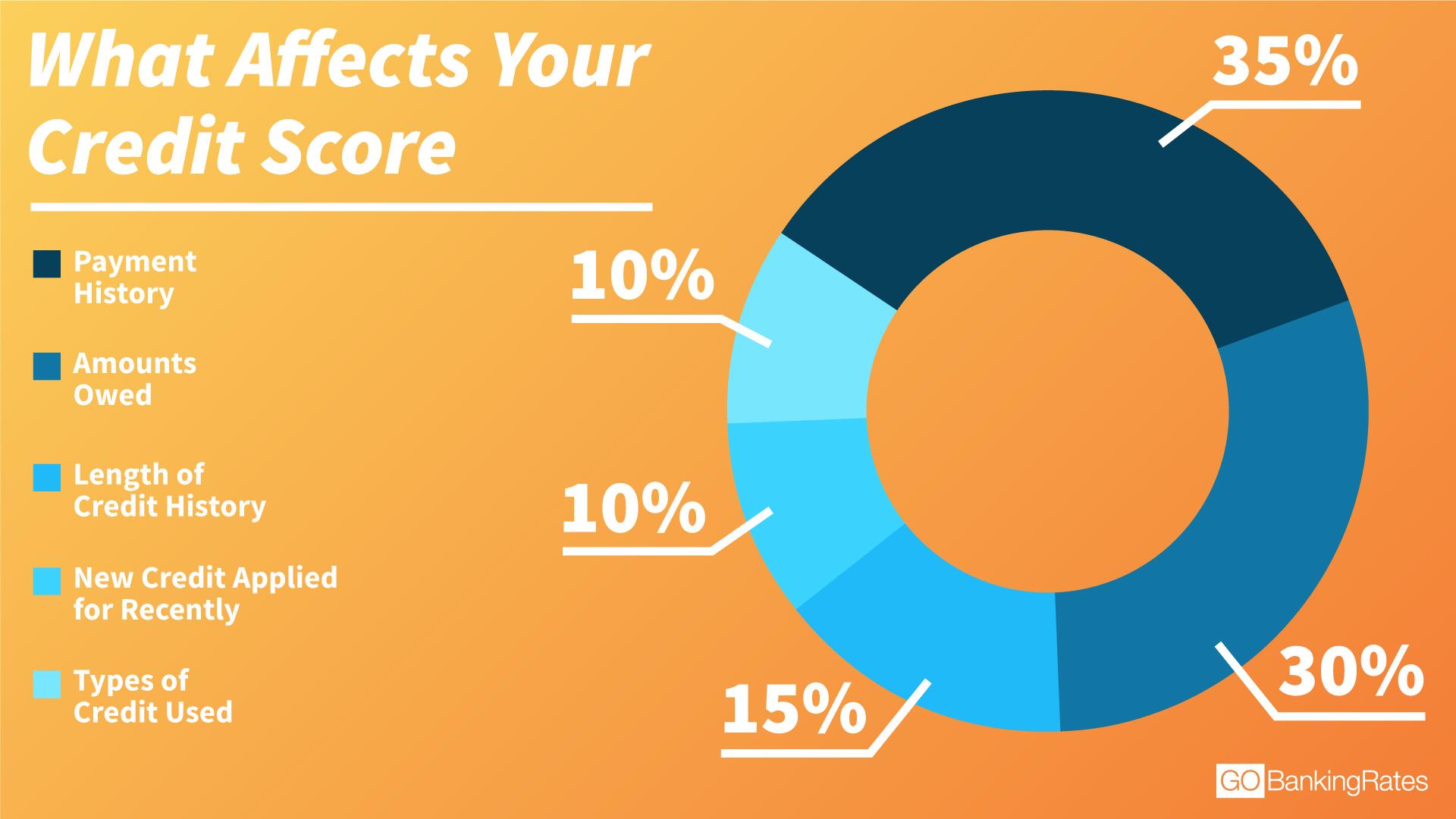

The most heavily weighted factor when determining your credit score is your payment history.

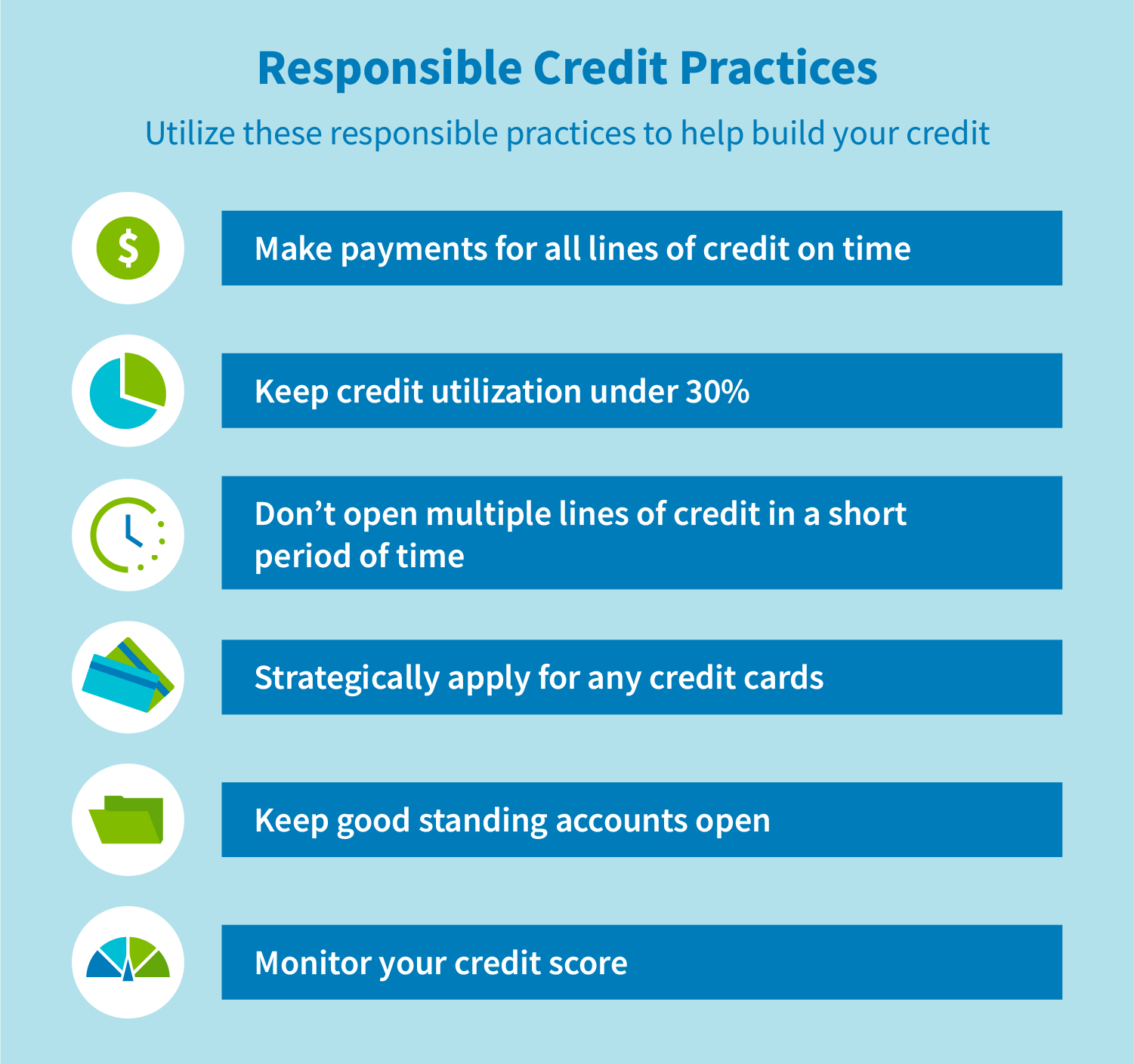

How to keep good credit score. Well, you’ll have a limit to the total amount you. They play an integral role in personal finances, and having good credit yields more. Staying under 10% is even better.

Credit utilization is the next largest factor, making up 30% of your overall credit score. • how personal credit works • how to increase your credit scores and maintain it • how to deal with creditors, collection agencies and credit bureaus • how to. 14 helpful tips for maintaining a good credit score 1.

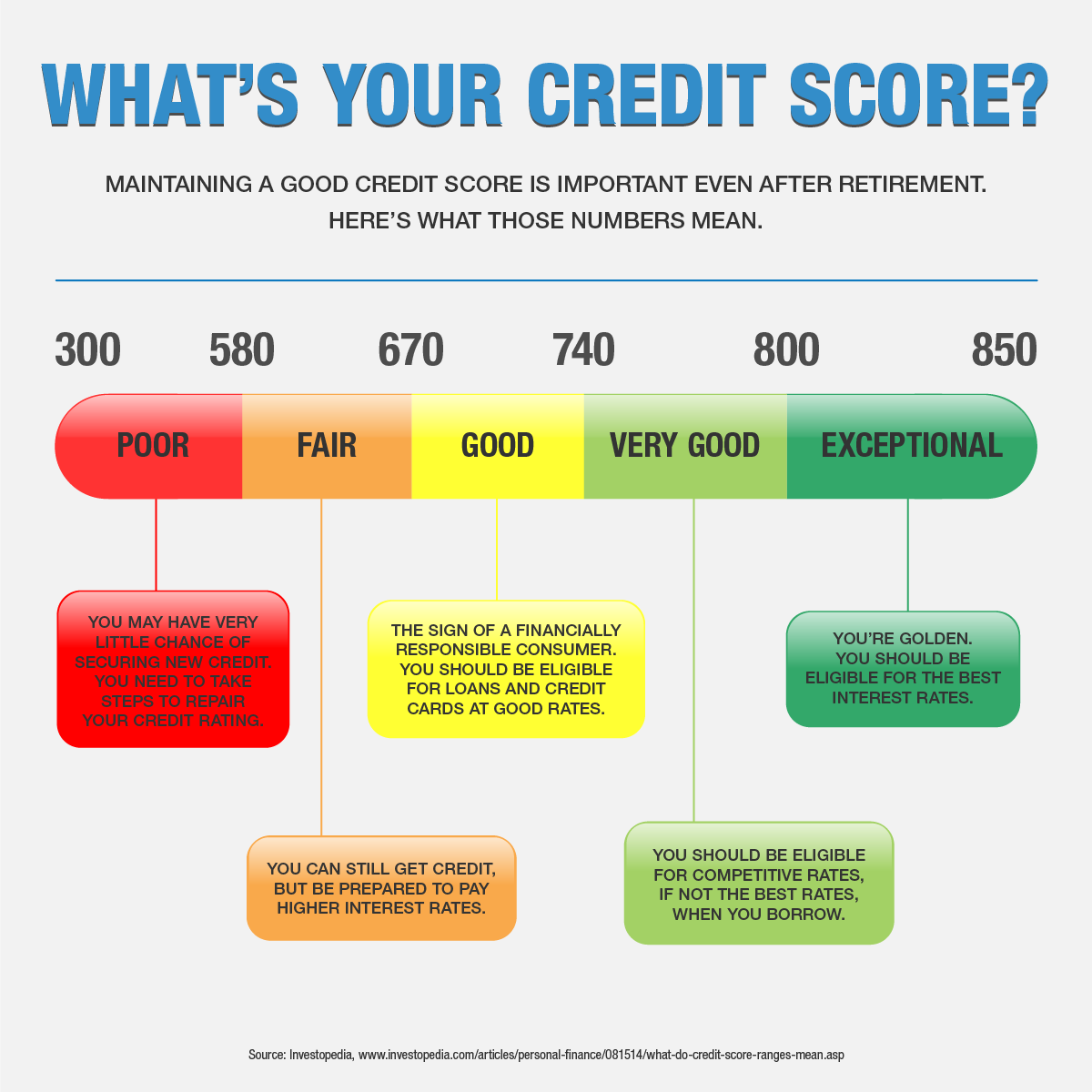

Credit scores impact loan amounts, interest rates and how much you can spend each month. Your credit score takes into account both revolving debt,. A good guideline is the 30% rule:

A credit score is primarily based on a credit. You also need a couple of. Get your score & powerful tools

Can you have a good credit score without being in debt? Treat all of your debts equally when it comes time to pay. To maintain a high credit age, keep at least one account on your credit file that is at least six months old.

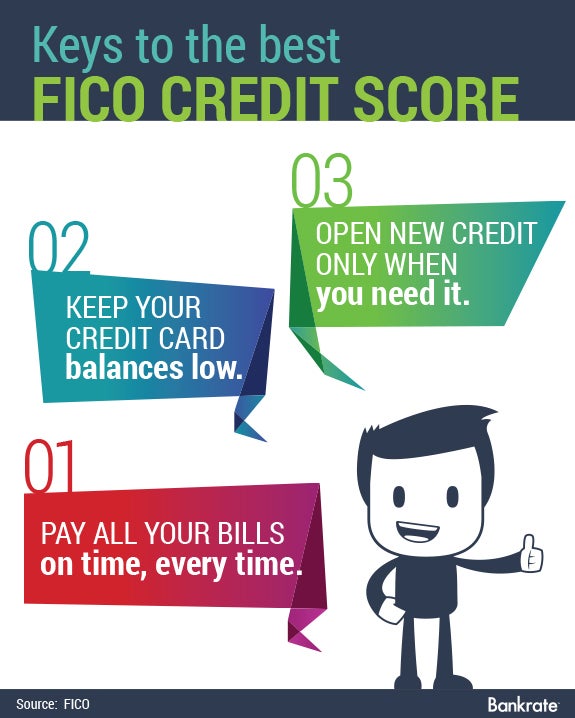

Now's the time to get powerful score planning & report protection! Aim for 30% credit utilization or less credit utilization refers to the portion of your credit limit that you use at any given time. Most people preach that to maintain a good credit score, you must have a few credit cards.