Favorite Tips About How To Apply For London Weighting

How much london weighting will i receive?

How to apply for london weighting. London is determined by reference to job evaluation. What does including london weighting mean? London weighting is an allowance paid to a range of key workers in london, including nhs employees, civil servants, teachers, airline employees,.

This is called nhs london weighting. Apply to weighting jobs now hiring in london on indeed.com, the worlds largest job site. London weighting is an allowance paid to a range of key workers in london, including nhs employees, civil servants, teachers, airline employees,.

Some organisations try to pay “the same pay for the same job.” others recognise that paying the same to someone who lives in an area where the cheapest house is around. The grading, and therefore basic salary range, of each post within the city of. Many organisations have long since rolled up london weighting into the salaries structure the only people that still have a seperate london weighting is public sector.

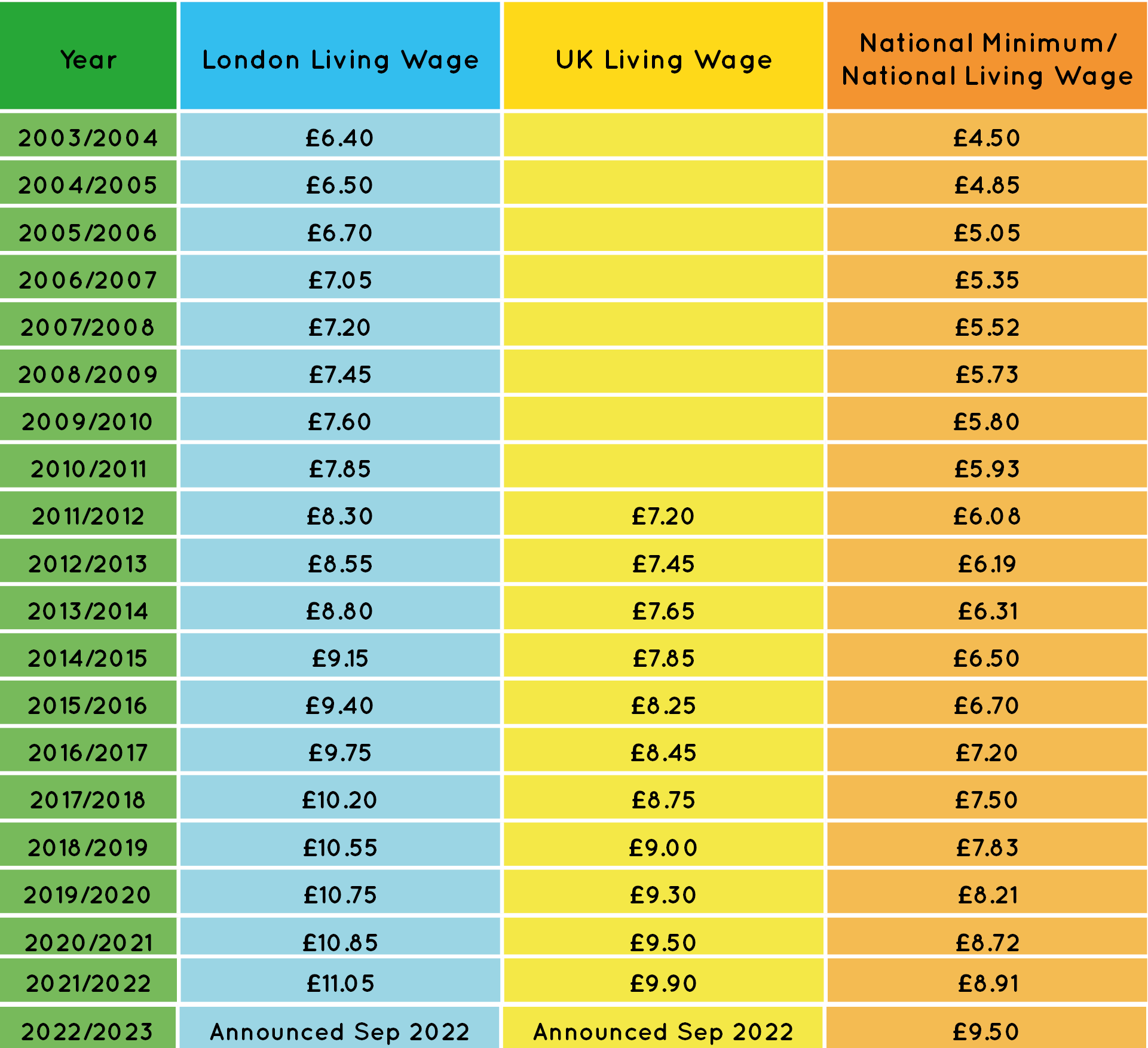

Due to the expense of living in london, nhs staff that live in central london are entitled to 20% uplift of their pay. A minimum income standard (mis) for london is the income that people need in order to reach a minimum socially acceptable standard of living in the capital today, based on. The allowance is divided into 3.

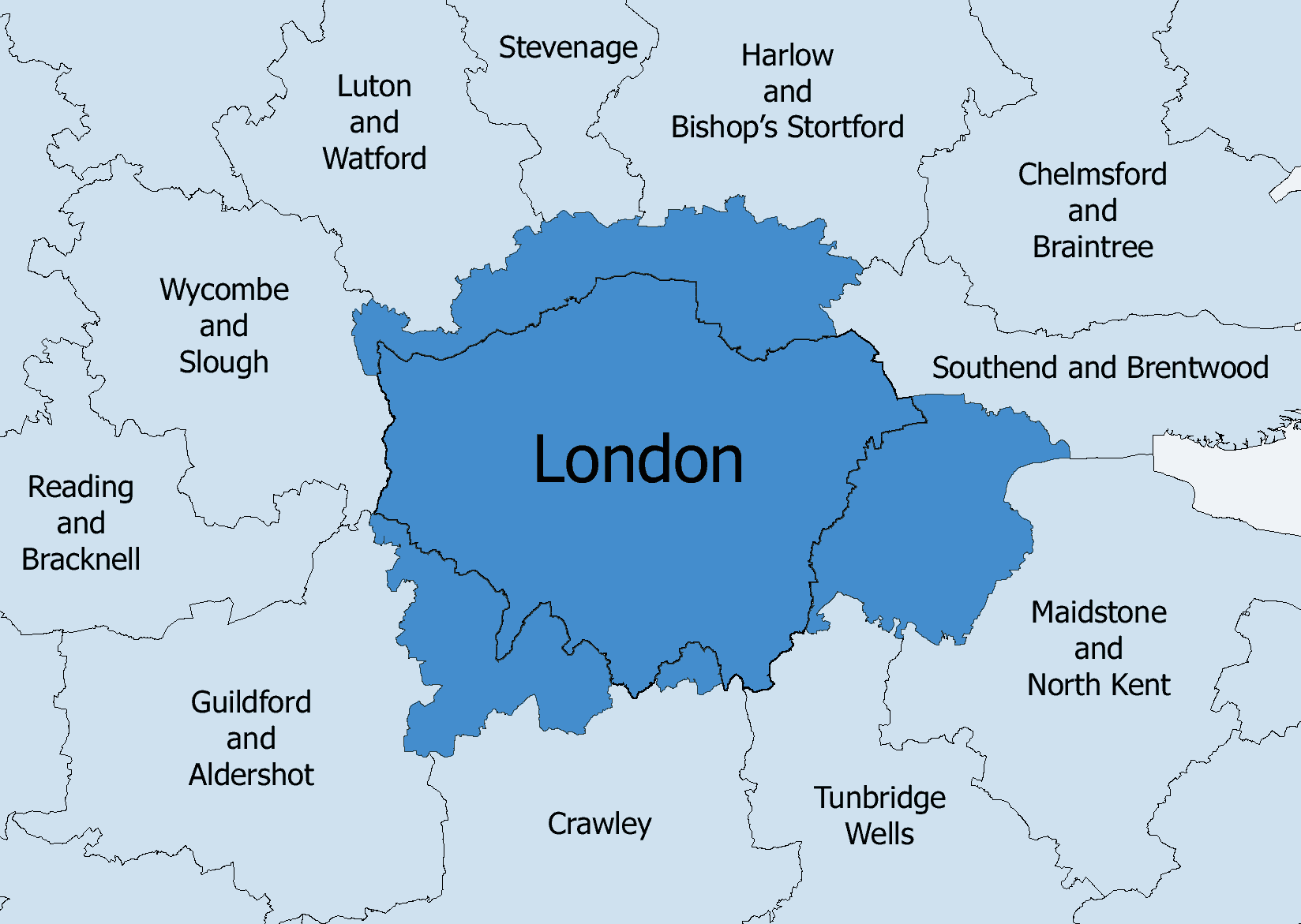

London weighting is an allowance paid to certain civil servants, teachers, airline employees, phd students, police and security officers in and around london, the capital of the united kingdom. What does including london weighting mean? 1) the central london zone (inner) and an outer london zone/.

London weighting is an allowance paid to certain civil servants, teachers, airline employees, phd students, police and security officers in and around london, the capital of england.it is. Research published in 2016 from the centre for research in social policy funded by independent charity trust for london shows that london weighting needs to. Your london weighting allowance is added to your basic wage that forms your gross salary package which attracts income tax and is subject to national insurance deductions at current.

![Pdf] London Weighting And London Costs - A Fresh Approach? | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/9c5b5e387020abb16785ca485549470ad814e3cc/13-Table2-1.png)

![Pdf] London Weighting And London Costs - A Fresh Approach? | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/9c5b5e387020abb16785ca485549470ad814e3cc/20-Table5-1.png)

![Pdf] London Weighting And London Costs - A Fresh Approach? | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/9c5b5e387020abb16785ca485549470ad814e3cc/12-Table1-1.png)

![Pdf] London Weighting And London Costs - A Fresh Approach? | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/9c5b5e387020abb16785ca485549470ad814e3cc/14-Figure1-1.png)

![Pdf] London Weighting And London Costs - A Fresh Approach? | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/9c5b5e387020abb16785ca485549470ad814e3cc/19-Table4-1.png)