Beautiful Info About How To Lower My Apr

One thing is for sure, us humans are instant gratification entitlement.

How to lower my apr. From there, simply say you’d like to lower your interest rate. If the representative says they. There are countless credit cards — all with different rewards options.

If you’ve already taken out an auto loan and want to reduce the existing apr, you can refinance the loan to a lower apr, a longer term, or both. Many people in troubled situations may inquire about closing their accounts altogether because it is too expensive to maintain. The instinctive reaction is to choose lender “z” because of the seemingly lower rate.

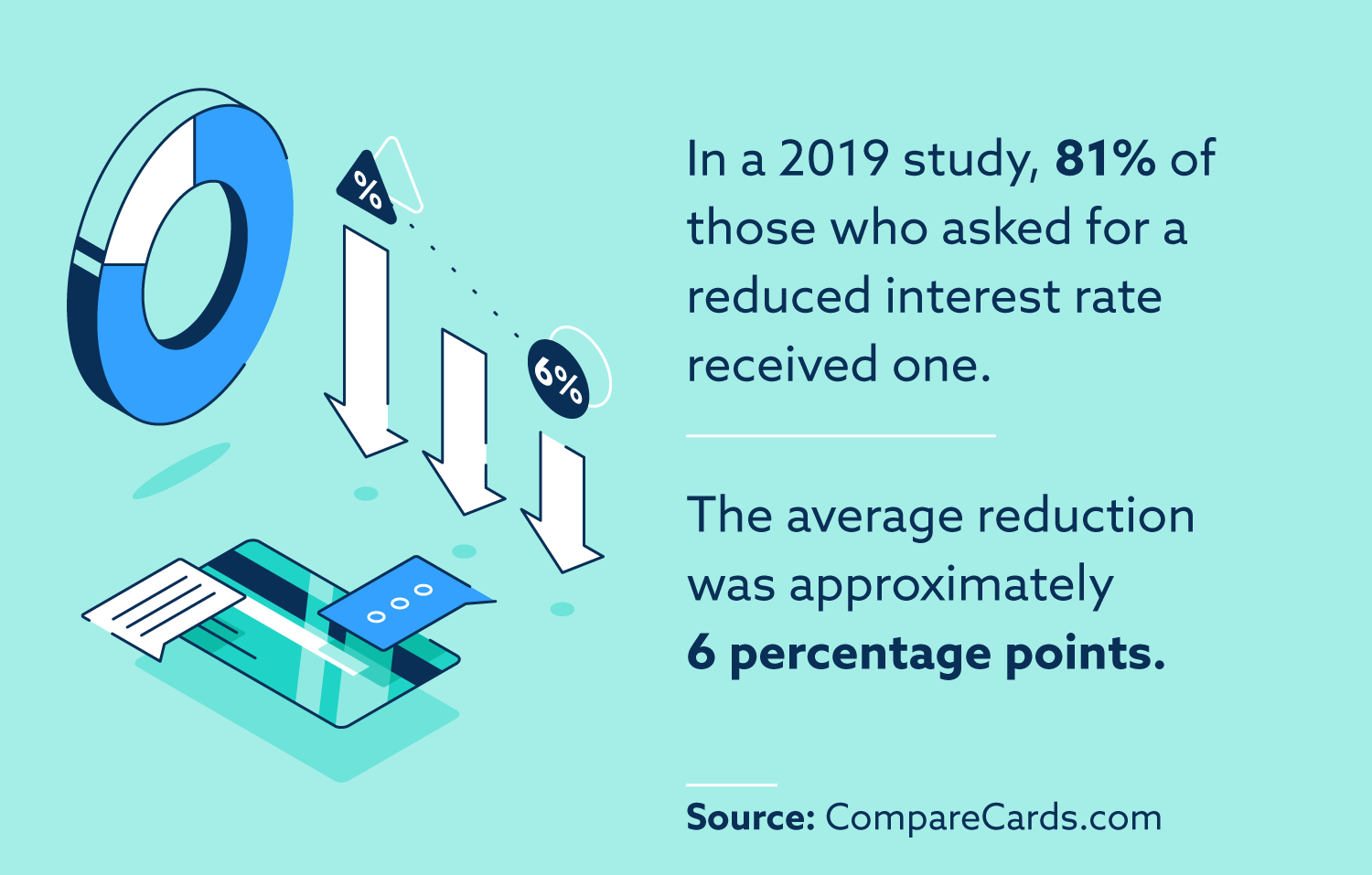

The squeaky wheel really does get the grease. Persistence is key when negotiating a lower credit card apr. How to lower your credit card interest rate 1.

A good course of action is to. Yes, part of the secret to a lower credit card apr is asking, but the bigger secret is persistence. You need to call them and ask them to lower your apr!

Having a good credit score will help you get an. It’s best to pay off your balance in full but if you don’t or can’t, a higher apr makes your debit grow faster. To lower your apr, you need to have a good credit rating and a steady job.

Because your credit score can be a factor in. Some credit card issuers have hardship plans that may temporarily lower your apr or minimum payments. Take your apr and divide it by 12 (12 months in a year) and then multiply that by your monthly balance.

![How Can I Lower My Car Loan Interest Rate? [6 Important Guidelines]](https://blog.way.com/wp-content/uploads/2022/02/REFINANCE-BANNER.png)

![How Can I Lower My Car Loan Interest Rate? [6 Important Guidelines]](https://media.giphy.com/media/4PHK0XUNIW1S1jAK5T/giphy.gif)